La Jornada – Sending cash resources to families in Mexico decreased by 40%

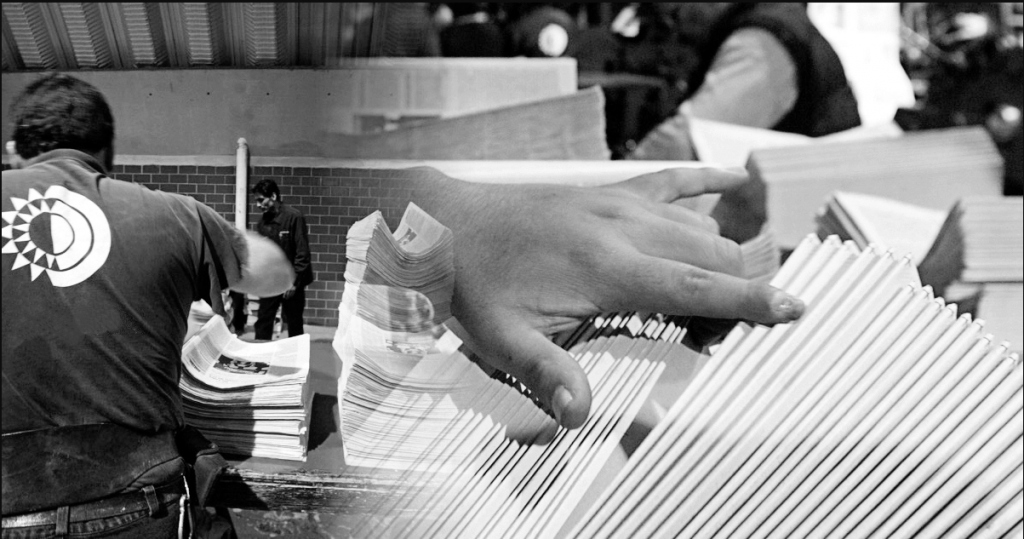

After the beginning of this year, the country’s financial authorities implemented measures to facilitate sending money from the United States through electronic channels. In the first five months of 2021, cash and in-kind transfers decreased by 40 percent compared to the same month. Official numbers.

According to information from the Bank of Mexico (BdeM), between January and last May, the country entered the country with $74.9 million in cash transfers, an amount that contrasts with $122.1 million in the same period last year.

Although this type of inflow does not represent even one percent of the total family remittances for the first five months of the year, which amount to 19 thousand and 178 million, its flow is mainly in the small and remote locations of the country, as well as in the northern borders of the country.

At the end of 2020, Senator Ricardo Monreal promoted an initiative that sought to amend the Bank of Mexico law to force it to obtain dollars that financial institutions in Mexico would accept and then could not send to the United States, arguing that if the banks had already done so. It cannot be exchanged for pesos, millions of Mexicans who depend on this income are affected.

The procedure was immediately interpreted in various circles as a “tailor-made suit” for Banco Azteca, owned by Ricardo Salinas Blego, the third richest person in the country, since this entity does not have a correspondent in the United States to exchange its dollars for peso.

Financial institutions and specialists immediately warned that the initiative could open the door for the Central Bank of Bahrain to obtain illegal funds and infect its reserves.

At the beginning of 2021, banks and financial authorities came together to introduce a series of measures to support immigrants and their families to change their dollars into peso at a better exchange rate through a strategy consisting of banking transactions for Mexican immigrants in the United States. United and their relatives in Mexico through the Banco del Bienestar.

In this regard, Marcos Daniel Arias, an analyst and specialist in remittances at Grupo Financiero Monex, emphasized that it was these measures taken by financial institutions and authorities that helped further reduce foreign exchange entering the country in cash or in kind.

“After this attempt to reform BBK, there have been efforts by Mexican embassies, banks and authorities to further facilitate foreign currency shipments from abroad, and part of the 40 percent annual reduction is due to this effort,” he said.

For his part, Jesus Cervantes, director of economic statistics at the Center for Monetary Studies of Latin America (Cemla), stressed that the other factor that affected the decline in remittances is the epidemic, as the money that the immigrant brings physically during his life. Country visits.

“The Covid-19 pandemic has reduced travel, which has affected cash transfers and it should not be ruled out that it will be replaced by electronic transfers,” the specialist said.

“Future teen idol. Hardcore twitter trailblazer. Infuriatingly humble travel evangelist.”