Episode 6 recap of Pluribus, the new sci-fi series on Apple TV. Every week since PluriBus' premiere, I have been presented with a few burning questions about the future.And about most of these, when we really want to answer, we...

Im Schlussabschnitt haben die Russen die Chance, sich mit 0:2 und 96 Punkten zum 2:2 zu scheiden.Anständige Moral. Vor den Augen ihrer Söhne: Ehemann ersticht seine Ex-Freundin mit einem Küchenmesser Hohe Moral in Hannover: Prusias Glück im letzten Schluck Gewinnen...

Amidst all the hype surrounding Washington, Friday's event should focus on kicking off football's biggest showcase. When sculptor Joel Shaapiro created the blue, the shadow behind the JOHN F Kennedy Center for the Arts on the Potomac in Washington, he...

ARR Sciences of New York is launching a vaccine in the Netherlands to prevent fentanyl-related overdoses and deaths. A small amount of fentanyl, equivalent to a few grains of sand, is enough to stop a person breathing.The synthetic opioid is...

Es wird sehr bitter sein!Beim FC Bayern ist Thomas Müller (36) Rekordmeister und kann regelmäßig spielen. Müller-Verletzungssorgen: Kann der Traum vom Finale gegen Messi wahr werden? Es wäre sehr bitter! Beim FC Bayern galt Thomas Müller (36) mit 17 Jahren...

Binge One Hour explained one or two of the three films. When you think about how the second Trump administration left the culture, a few important things come to mind.For example, Stubert, Jimmy Kimmel, or CBS news, but business is...

Auch nach dem Ende des Spiels gab es viel Feuer im Derby!Nach einem 3:1-Sieg gegen den Erzrivalen Carl Zeis Jena Nach dem Feuerwerk: Rot-Weiß Erfurt bestraft Torwart Otto Selbst nachdem das Spiel vorbei war, brannte dieses Derby! Nach einem 3:1-Sieg...

In the short term, Sanders has done enough to earn another start.But the long term is still up in the air. Shedeur Sanders argued against the 'microwave' approach after his 2nd start.But will the Browns listen and give him enough...

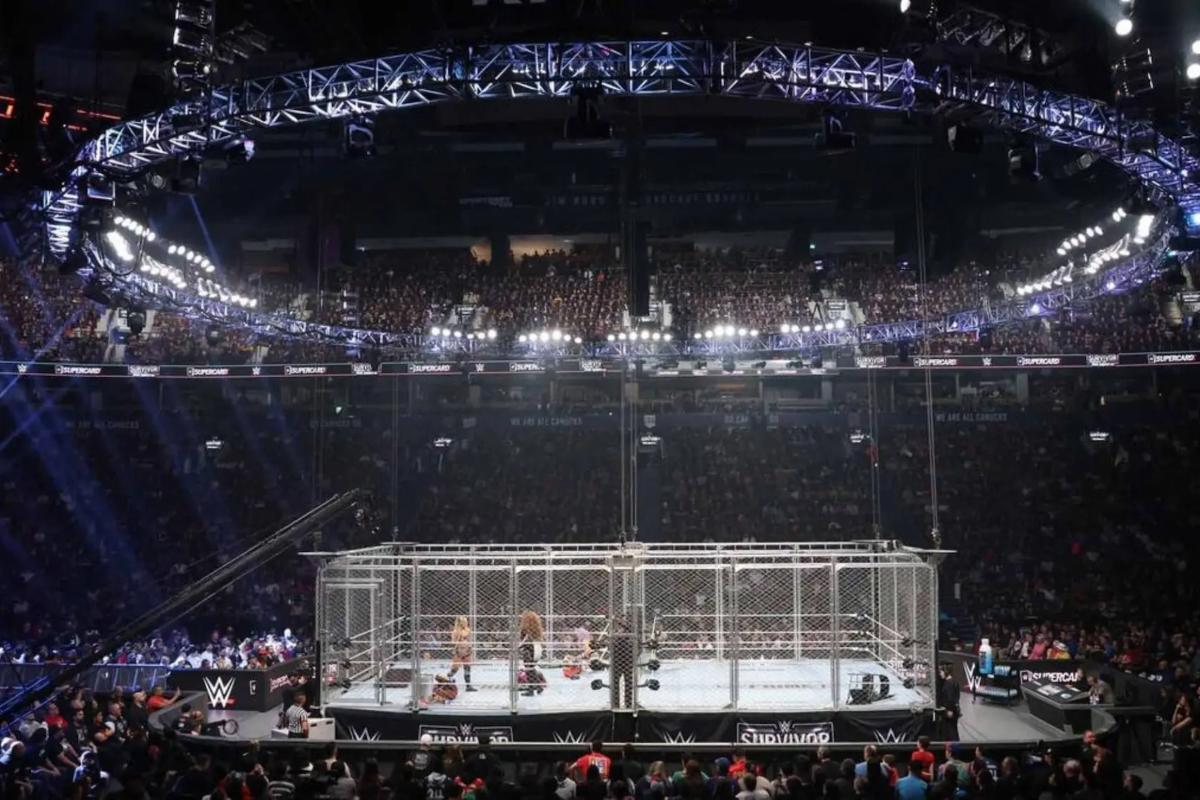

Former WWE World Women's Champion Liv Morgan is reportedly returning at "Survivor Series 2025." One of the top stars of WWE is reported to return in Warth Express 2025. Pwirider of Liv Morgan will make the return "Lightning" in San...

The president offers creative participation in possible future projects. President Donald Trump has strong views on the news media and a vested interest in asserting them;he has long claimed credit for ending the careers of journalists and comedians.CNN employees now...